The latest August reading show that , underlying demand for housing remains strong. We see this as a result of solid labor market, low unemployment rate, continuation of low mortgage rates, and now we are even starting to see wage growth. Of course tight inventory levels continue to drive up pricing making affordability a bigger and bigger problem.

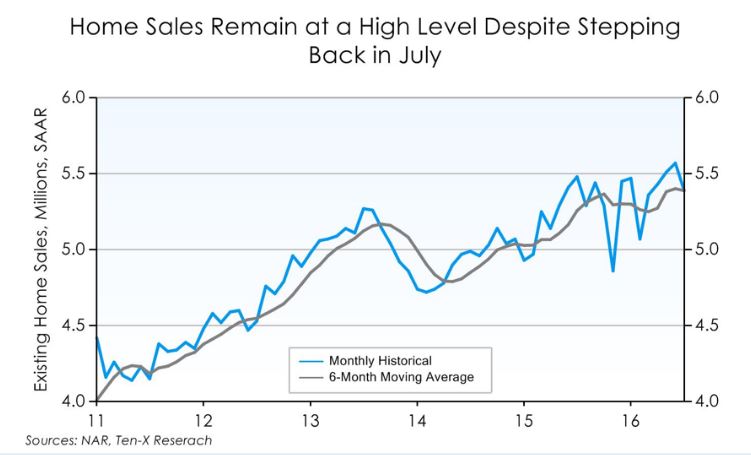

We did see a drop of 3.2 percent in July leading to a seasonally adjusted 5.39 million rate. The sales rate in July showed a 1.6 percent year-over-year decrease.

Median home pricing in July was $244,100 in July—a 5.3 percent increase from a year ago and the 53rd consecutive month of annual gains.

In July the total inventory of houses for sale was 2.13 million existing homes for sale. This was 0.9 percent higher than last month but still 5.8 percent below last year’s level. Tight inventory levels continue to hold back sales growth.

In July, 21% of the sales were all cash down from 22 percent from June and 23 percent from a year ago. This was the lowest we have seen since November of 2009. This represents a continuing drop in the sales of distressed properties, showing that the housing market continues to stabilize since the bust in 2007.

Even though month’s headline sales figure showed some signs of weakening , it looks like the overall sales levels shows continuing health in the housing market. they still believe that the high overall sales level continues to signal the health of the housing market.